In opening up this dialogue I understand that some may call me a boomer hater. They’ve hurled that nickname at Dr. Paul Kershaw (http://gensqueeze.ca/) and are potentially going to paint me with the same brush. The truth however is quite the opposite.

My parents are boomers and have admittedly enjoyed a life that was built on hard work and blessed with a mix of opportunity and good timing. They are both incredibly smart and cautious and loving and politically active and now enjoy the high quality of life that they have earned.

They eloped in 1969 on New Year’s eve. My dad says the reason they rushed to marry on that day was that in doing so he was able to claim my mom as a dependant for the whole of 1969. This resulted in a tax return large enough to pay for their honeymoon. Mom had been a flight attendant and was able to get free tickets to Turks and Caicos so they stayed the first night in a fancy hotel, got to know all the staff, then moved to a cheap hotel and snuck back to the fancy one during the day to enjoy the pool. Their ‘wedding’ and honeymoon is so remarkably different to the current trend of $30,000 debt-inducing ‘dream weddings’ and is a tribute to the way things were back then. Gen Squeeze is coming of age in a time when marketing forces are more powerful than ever and we need to see that it wasn’t always like that. While we lament the difficult economy in which we are raising our families we must admit that we could learn a thing or two from the spending habits of young boomers.

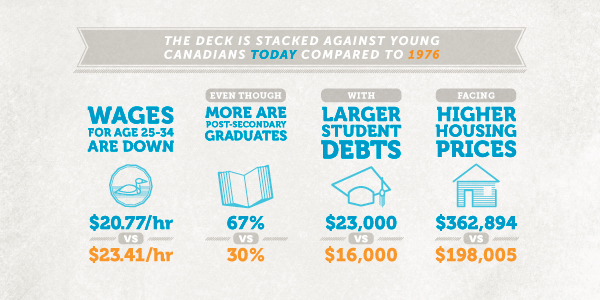

While my parents made the smart choice to have a wedding that was within their means they were then able to buy their first house, just a few short years later, for $19,000. They were able to do so on a single income while raising three young children – something that is next to impossible for today’s Gen Squeezers. They started their married life without any debt (not even student debt) – something that is increasingly rare for the Gen Squeezers. They had no child care costs whatsoever – an expense that now cripples most of todays parents with fees up to $1,000 per month for one child. In short times were different!

As we discuss the then vs now data we must be careful not to vilify those who benefitted from then any more than we can blame those who are struggling now. I look to the Boomers as a source of inspiration, guidance and mentoring as they had the wherewithal to be cautious financially and active politically. In return I’d like the boomers to look at my generation with a sense of understanding and compassion. While Gen Squeeze could stand to be more frugal we are not blowing our money the way you think we are….we are just paying way more for our basic necessities like housing, food and gas and have the added unbearable burden of paying for child care and student loans on top of it all.

All we ask is for open dialogue and understanding about what it’s really like to raise a family in 2013. Once we stop pointing fingers and laying blame we can get to work building social policies that reflect the needs of today’s Canadian family.